As I mentioned in the my previous blog entry, when one is scouting for health insurance policy, there are three criteria one should be comparing: 1) The amount of coverage during hospitalization; 2) The types of coverage after discharge, including out-patient treatment; 3) The claims limit per policy year and per lifetime. Let’s compare the benefits of AIA Plan A with NTUC Basic Plan.

AIA HealthShield Gold Plan A Benefits

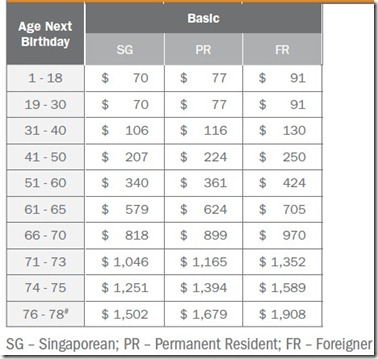

NTUC Enhanced IncomeShield Basic Plan

Now if I were to choose based on my first criterion, i.e. amount of in-patient coverage, and if I were to opt for a Class B1 ward (an air-con ward with four beds and an attached bathroom; B1 ward and above are considered non-subsidized ward), NTUC Basic Plan will pay as per charged, whereas AIA Plan A capped it at $830 per day in any ward or $1300 per day in ICU. But if I consider the surgical benefits, NTUC Basic Plan will pay as per charged, unlike AIA Plan A which has a cap limit.

Next, if I were to compare the out-patient treatment benefits, AIA Plan A cannot hold a candle at all to NTUC Basic Plan as the latter plan pays as per charged. AIA Plan A loses out by a wide margin in this category.

Lastly, if I were to compare the claim limit per policy year, AIA Plan A also loses out by another wide margin as well. AIA sets a cap limit of $120,000 per policy year, while NTUC Basic Plan sets $150,000. But for lifetime limit, there is no limit at all for NTUC Basic Plan, while AIA Plan A caps it at $5 million for lifetime.

Now it is clear which is the winner. But if you think the premium for NTUC Basic Plan should cost at least twice AIA Plan A, here’s the truth.

Premium Table for AIA HealthShield Gold Plan A

As you can see, if you are a Singaporean, you are paying a premium for NTUC Basic Plan at a price way below that of AIA Plan A. Even if you were a foreigner, it will still be cheaper if you were to purchase NTUC Basic Plan. In my previous blog entry, I have argued that if the premium is affordable for you, go for the NTUC Preferred Plan. In this blog entry, I am comparing the insurance policy I am holding now with NTUC Enhanced IncomeShield Basic Plan. It is very obvious which plan is more superior. I am disappointed that the insurance company which I have grown to trust so much is losing its edges, and is not revising its policy to maintain a competitive edge against other insurance companies.

I would like to urge the AIA management team to re-examine the policy their company is offering their clients. What matters at the end of the day is that their clients can afford quality healthcare services and the insurance company can be proud to claim that they have their clients at heart. It is critical for an insurance company to be willing to go all the way to enhance its reputation as a trustworthy insurance company who values clients as their core mission, rather than profits, because ultimately insurance company is dealing with human's lives. The insurance agents themselves will derive great satisfaction from meeting the real needs of humans rather than selling a package deal for commission, and this itself is a great source of motivation.

May AIA one day rise to the challenge of meeting real human needs rather than being focussed on commission, and may they set the standard which other insurance company will hold up to one day.

May AIA one day rise to the challenge of meeting real human needs rather than being focussed on commission, and may they set the standard which other insurance company will hold up to one day.

No comments:

Post a Comment